Challenges

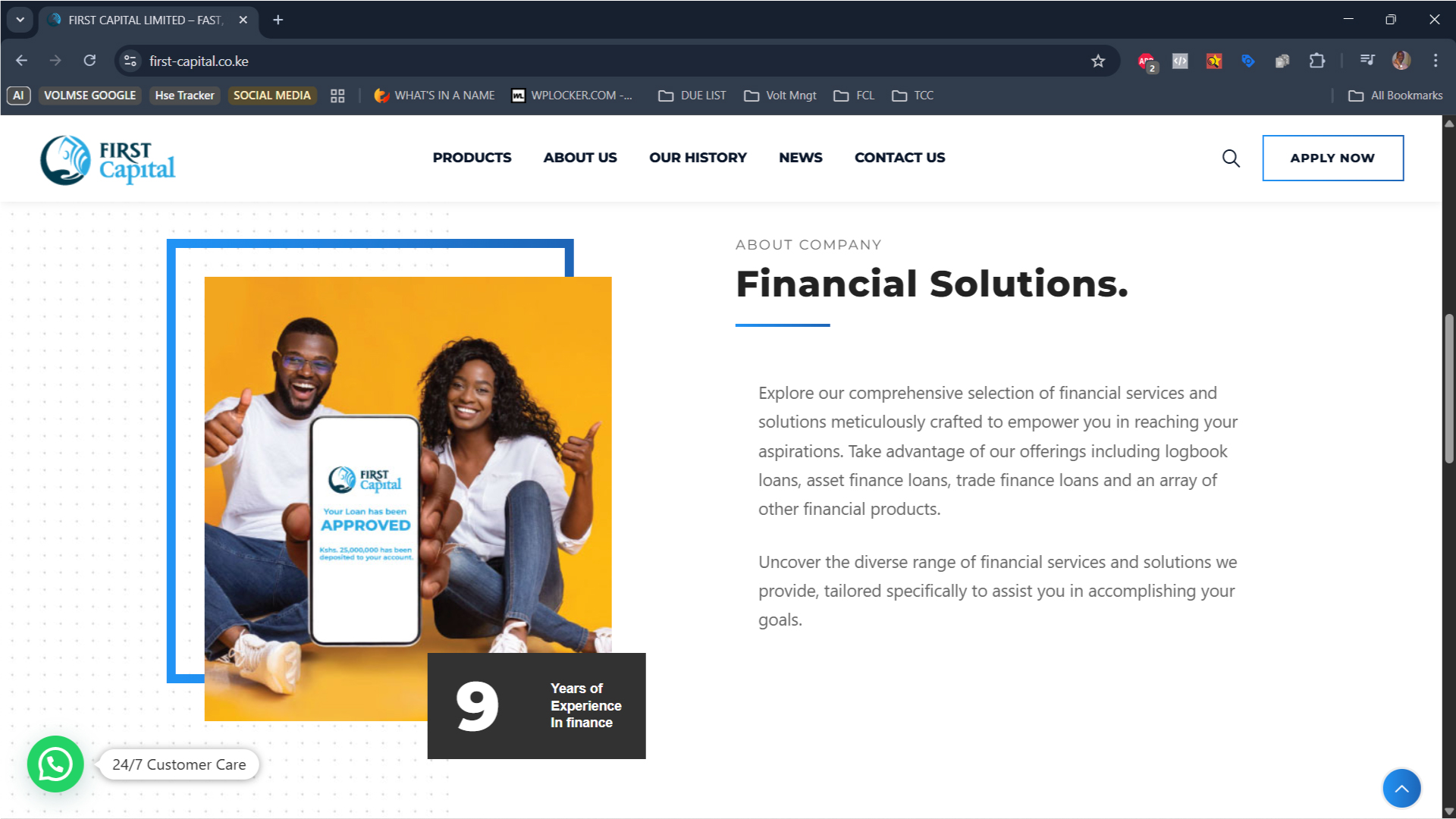

- The site had many service offerings, but users found it difficult to understand which product matched their needs.

- Messaging around rates, fees, and approvals lacked clarity, which reduced trust and drove hesitancy.

- Conversion paths (i.e. from visiting the site to applying / contacting) were dispersed and not optimized.

- Lead capture and speed of response were not always evident; some users lost interest due to perceived complexity.

- Search visibility (SEO) for financial product terms was weak, reducing discovery of First Capital’s services.

Solution

- Conducted a brand‐messaging workshop to articulate First Capital’s value proposition: speed, simplicity, fairness. Defined personas (e.g. small business owner, vehicle owner, LPO requester).

- Redesigned the website navigation and service pages to group offerings in an intuitive way, with clear differentiators and simplified loan flows.

- Wrote transparent content explaining terms: what is required, how approvals work, interest, repayment options, etc.

- Added strong call-to-action buttons (“Apply Now”, “Get Quote”, “Contact Us”) at stages aligned with user intent.

- Integrated lead forms & instant chat options to reduce friction in inquiries.

- Improved site SEO: targeting relevant financial and loan keywords (e.g. “logbook loans Kenya”, “LPO financing”, “asset finance rates”).

- A/B tested messaging around “quick approvals” vs “low interest” to see which drives more trust / click-throughs.

Results

| Metric | Before Project | After Project | Growth / Change |

|---|---|---|---|

| Monthly Website Traffic | 4500 visits | 8000 visits | +78% |

| Lead / Loan Inquiries | 120 per month | 300 per month | +150% |

| Conversion Rate (visitor → application) | 2.0% | 5.5% | +175% |

| Average Application Drop-off Time | 4 days | same-day response rate | -75% |

| Customer Satisfaction (surveyed) | 70% satisfied | 90% satisfied | +20 pts |